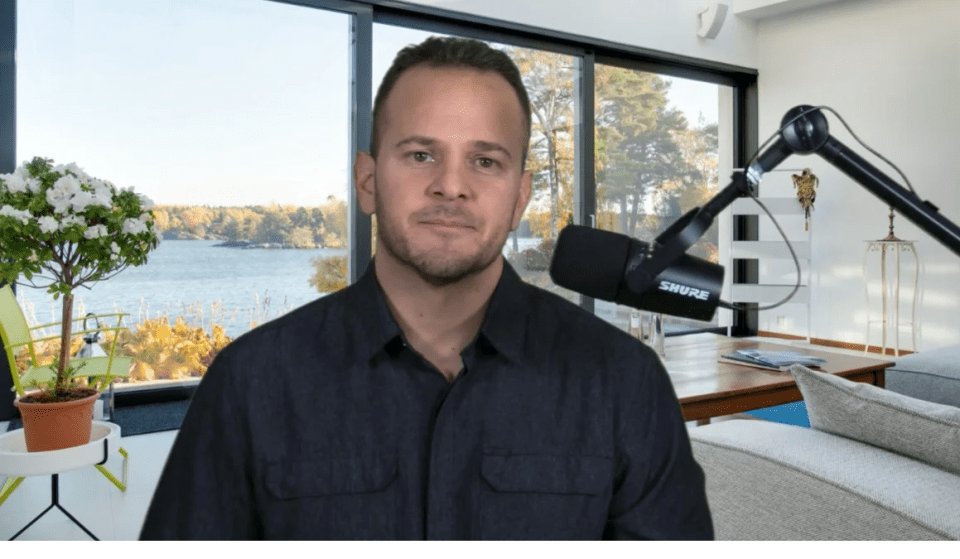

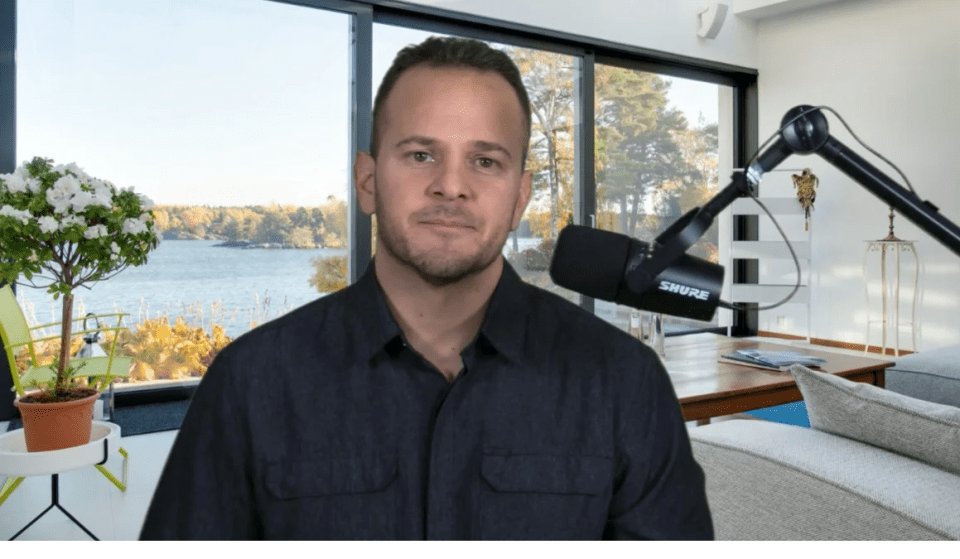

(Photo: Pastor Eligio Regalado)

January 16th, 2024–Colorado State’s Attorney General charged Pastor Eligio Regalado, whose surname ironically can mean ‘Gifted’ or ‘Given’, his wife Kaitlyn (also goes by the name Kathy), and their companies INDXCOIN, LLC, KINGDOM WEALTH EXCHANGE INC, KINGDOM WEALTH EXCHANGE LLC, GRACE LED MARKETERS, LLC, etc. on (also goes by the name Kathy) with civil fraud for creating, marketing, and selling a cryptocurrency called INDXcoin and then spending over a third of the invested funds ($1.3 million) on themselves.

Regalado, who pastors the online only Victorious Grace Church, announced his plan last April and soon sold the crypto coins to his and other Christian communities in the Denver under the moniker “Kingdom Wealth Exchange, LLC”. The project launched in June and then shut down in November.

We hope believers will take note and beware of religious affinity fraud. Affinity fraud leverages and exploits inherent trust within a group. For example, a fraudster may target a specific religious congregation. Oftentimes, the person will try to enlist the help of the leader of the group to market the investment scheme. In which case, the leader becomes an unwitting pawn in the fraudulent scheme. In this case, however, the pastor was the perpetrator.

One well-known example is Bernard Madoff who targeted Jewish communities. It’s not just a cliché when we say there is more money stolen in the name of God than any other way.

Ms. Tung Chan, Securities Commissioner for Colorado, said “We allege that Mr. Regalado took advantage of the trust and faith of his own Christian community and that he peddled outlandish promises of wealth to them when he sold them essentially worthless cryptocurrencies.”

Commissioner Chan’s civil complaint against the Regalado couple claims that from June 2022 to April 2023, the ill-fated crypto exchange raised more than $3.2 million from over 300 investors and that the couple’s sales pitches were filled with “prayer and quotes from the Bible, encouraging investors to have faith that their investment … would lead to ‘abundance’ and ‘blessings.’”

INDX Coin began trading its cryptocurrency on June 22, 2023. In its launch video that same day, “Pastor” Regalado said, “So this is the Kingdom Way, the Kingdom Way is to distribute even when you don’t have enough, trusting that God is going to multiply what you give thanks for.”

NOTE: This wishful thinking is one of the basic lies of the so-called “prosperity gospel.”

During INDXcoin’s launch video on Twitter/X, Regalado read Jesus’ miracle of feeding thousands of people with just a few loaves and fishes and applying this spectacular miracle to his Kingdom Wealth Exchange’s cryptocurrency.

Eli Regalado actually admitted to the theft in a video a few days after the charges were filed, saying, “The charges are that Kaitlyn and I pocketed 1.3 million dollars, and I just want to come out and say that those charges are true,” he said, adding, “A few hundred thousand dollars went to a home remodel that the Lord told us to do.”

Eli Regalado also said, “It’s not like we had $1 million sitting there and decided to go crazy with it”. You judge. Commissioner Chan’s legal complaint states that investment proceeds went directly to defendants Eli and Kaitlyn, or was used for their own personal benefit, including jewelry, handbags and lavish vacations and other expenses.

The Regalado couple owns a house and a condo in Lakewood Colorado. The real estate website Redfin says the home is a “2,088 square foot house on a 3.24 acre lot with 4 bedrooms and 2.5 bathrooms” and that “This home is currently off market. Based on Redfin’s Lakewood data, we estimate the home’s value is $1,126,521.” Redfin estimates the two-bedroom, two-bathroom, 837 square feet condo is worth $363,985.

Eligio Regalado incorporated the online church in 2020 and is its registered agent. The articles of incorporation for the church say that “No part of the earnings of the corporation shall inure to the benefit of or be distributable to any private individual or person; provided, however, that the corporation may pay reasonable compensation …” These good intentions lasted less than two years.

Note that according to Commissioner Chan’s civil fraud complaint, Victorious Grace Church has only two employees (Defendants Eli and Kaitlyn) and operates from the Regalado’s house, their recreational vehicle, or from the Regalado’s vacation destinations.

Earlier this month, we published a video about red flags to look out for and here are some we covered plus another one that time didn’t allow us to address:

- Beware if a person claims to hear from God about what others should do.

- Beware if a person believes he or she claims they have God’s favor to perform miracles.

- Beware if a person comes up with a way to raise money for others and then spends it on themselves.

- Beware if a person tells others they will become wealthy if they give or invest in a certain organization supposedly ordained of God.

- Beware of online only, TV only, or mail-order-only churches with no actual membership who can, as it happens, literally meet in person.

Many major news outlets reported on the story.

People Magazine: Denver Pastor Says ‘the Lord Told Him’ to Steal $1.3 M from Christians to Remodel Home

CNN: A Colorado pastor says God told him to launch a crypto venture. He’s now accused of pocketing $1.3 million from his followers

BBC: Colorado pastor accused of multimillion dollar crypto scheme

LAW&CRIME: ‘The lord told us to’: Online pastor says God told him to ‘pocket’ $1.3M after charges filed in alleged cryptocurrency scam

We ask our readers a question? Do you think the Regalados should sell their expensive house and move into their two-bedroom condo and distribute the proceeds of the sale to the defrauded investors?

The answer is obvious.