Pastor Ben Young preaching, May 19, 2025

Last spring, in a dispute over new church bylaws, a large group of concerned members of the 90,000-plus member Second Baptist Church (SBC) of Houston formed the non-profit Jeremiah Counsel Corporation (JCC) and filed a lawsuit against the church’s former senior pastor Homer Edwin Young, new senior pastor Ben Young, Lee Maxcy, Dennis Brewer Jr., and the Second Baptist Church Corporation.

This action was, they said, a last resort to reverse what they considered a hostile church takeover by what they collectively refer to as the “Young Group” – a new board composed mostly of immediate Young family relatives, staff and their lawyer, Dennis Brewer (more about Brewer below).

After contacting, or attempting to contact, former senior pastor Homer Edwin Young and new senior pastor Ben Young several times to reverse the damage, JCC began litigation, asking for three things:

- Restore member voting rights

- Put in place an independent, member-elected Board of Trustees

- Guarantee members access to church bylaws and audited financials

The Problem

Church leadership scheduled a special business meeting in May 2023 to vote on new church bylaws. Church members were not allowed to read the proposed bylaws before the vote. Instead, the church leaders falsely told the congregation the sole purpose of the new bylaws were to protect SBC from a “woke” agenda.

They didn’t realize the new bylaws concentrated all governing authority in the hands of the Young Group and consolidated power in the hands of one individual—initially Homer Edwin Young and then one year later to his son and his appointee, senior pastor Ben Young.

The new document gives Ben the power to hand-pick its board members which they are calling a Ministry Leadership Team (MLT). The new document eliminates checks and balances previously held by the former church’s bylaws and upheld by its trustees. It placed roughly a billion dollars of assets under the control of the Young Group.

A complete summary of the reasons for the lawsuit can be found on the JCC website.

According to JCC, “This is not about theology or personalities. It is about legal, ethical, and financial accountability… SBC (Second Baptist Church) was built by faithful members over generations. It belongs to the body of believers, not to one man or one family… If we stay silent, SBC will become a permanently private, family-controlled institution.”

The Defendants Are Not Victims

Defendants named in the 123-page petition are represented mainly by Mike Cash at Liskow & Lewis.

Dennis Brewer Jr. has his own lawyer. His Response to Plaintiff’s Motion… adopts the stance of victimhood when he mentions that Jeremiah Counsel Corporation’s brief reads more like a “hit job”. Poor Mr. Brewer. Perhaps he and the other defendants could claim victimhood if they weren’t the perpetrators of the alleged church takeover.

We say “alleged” but the allegations are strong, and compelling, and they are attested to by the many witnesses this author has interviewed. Our initial article, “A Story of Power, Deceit, and Betrayal…”, details how the situation evolved and how the defendants were given time and opportunities to reverse the current situation.

Defendant Dennis Brewer Jr.’s and Fellowship Church’s lengthy history and why it matters;

Dennis Brewer Jr.’s relationship with Ed Young’s Fellowship Church of Grapevine, Texas, isn’t mentioned in his brief to the court, but he’s had at least a 25-year history there serving in various capacities, including its legal counsel, a board member, and its CFO.

Fellowship Church’s Ed Young is Homer Edwin Young’s eldest son, Ben Young’s older brother, and Dennis Brewer Jr.’s sometime fishing buddy.

Fellowship church began as Las Colinas Baptist Church, then became the Fellowship of Las Colinas in 1991, and Las Colinas Fellowship in 1998 (amended articles here) controlled by a board of trustees elected by a vote held by a quorum of at least one-tenth of the voting members of the congregation. It became Fellowship Church in 2001 when the organization once again amended its articles of incorporation.

At that point all power was removed from the church’s board of trustees and plenary power (unqualified, absolute power) placed in the hands of a newly formed Ministry Leadership Team comprised of Ed Young, Dennis Brewer Jr., and two other men (Amended and Restated Articles of Incorporation Article 8, Board of Directors). These articles claim they were approved at a “a properly noticed meeting”, but if indeed Fellowship Church’s 2001 business meeting was properly noticed, did church members know they were permanently eliminating their right to vote?

Brewer Jr.’s history of eliminating church members right-to-vote with Fellowship Church

Fellowship Church has a history of church takeovers that left several failed churches in its wake (read here: Ed Young’s Toxic Church Business Practices and Mergers Infect Second Baptist Houston and Other Churches)

- Fellowship Church merged with First Baptist Church of South Miami in 2006. The merger document reads, “Fellowship Church has no members entitled to vote on this plan of merger. The plan of merger was adopted by a unanimous written consent resolution of the board of directors on July 19, 2006 by all directors entitled to vote.”

- Article 9 of Fellowship Church Florida’s articles of incorporation, executed by Laura Lang of Brewer’s law firm on September 24, 2015, reads “plenary (complete) power to manage and govern the affairs of the corporation is vested in the board of directors of the corporation.”

- Fellowship Church merged with Primera Iglesia Bautista Hispana, Inc on July 29, 2012. Article 6 of the merger reads, “There are no members of the surviving corporation, Fellowship Church, entitled to vote on the articles and plan of merger. The plan of merger was unanimously adopted by the board of directors effective as of July 29 2012.”

- In 2018, Fellowship Church South Biscayne, Inc. merged with Fellowship Church. Article 6 of the merger reads, “There are no members of the surviving corporation, Fellowship Church, entitled to vote on the articles and plan of merger. The plan of merger was unanimously adopted by the board of directors effective on March 20, 2018.” Both Ed Young and Dennis Brewer Jr. signed exhibit A of the merger document.

- Fellowship Church Norman in Norman, Oklahoma, formerly known as Journey Church, was closed not long after Fellowship Church in Grapevine took control. It’s a good bet that all voting rights of church members were eliminated there as well.

A Long relationship with the “prosperity gospel”

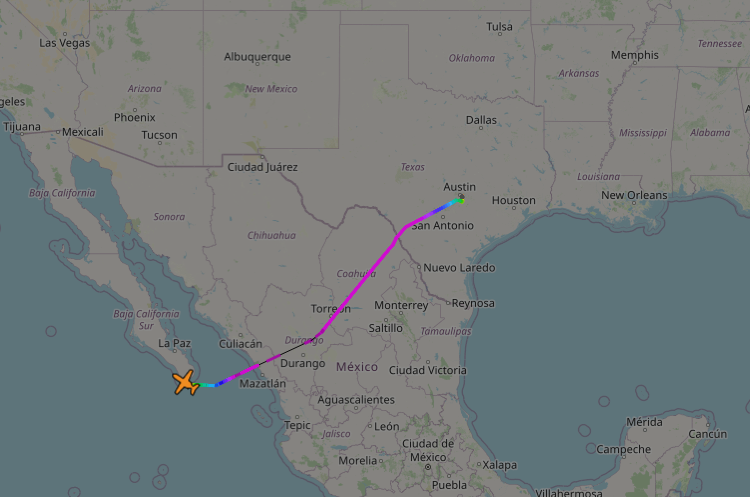

The church also has a long relationship with the “prosperity gospel” and pastor Ed Young’s well-documented lavish lifestyle, having lived in successive multi-million-dollar mansions, utilized private jets, etc.

Social media photos placed Ed and his wife Lisa Young at a very large, expensive mansion in the Florida Keys, a house valued by real-estate site Redfin at $8,876,000.

The trustee owner of the mansion is LaurelB, LLC, a Delaware limited liability company that isn’t current in Delaware and may no longer exist. The authorized agent who signed the mortgage document is Dennis Brewer, Jr. Ed Young’s dad, Homer Edwin Young was born and raised in Laurel, Mississippi. Coincidence? Perhaps.

Trinity Foundation believes that Dennis Brewer, Jr. operated as a “straw buyer” to purchase the property on the Young’s behalf. The new Florida Keys beach house purchased followed the sale of the Young’s prior Florida Keys beach house.

The Youngs have received massive housing allowances from Fellowship Church, affording them the opportunity to acquire extravagant real estate. Currently, the Youngs own a mansion in an exclusive gated community in Westlake, Texas, as well. The gated neighborhood is home to the privately owned 18-hole Vaquero Golf Course and the community offers “unparalleled opulence”.

Brewer’s Brief

Brewer’s brief claims church autonomy as if he and the Young Group are above the law.

His brief mentions that self-perpetuating boards are common in the rest of the non-profit world, as if Mr. Brewer assumes churches are supposed to be run like many other secular non-profit organizations. However, it’s a practice that is frowned upon in the secular world, when the board is comprised of mostly family members.

Best Governance Practices: Why This Case Matters

Dennis Brewer’s Jr.’s brief states, “The Ministry Leadership Team is a self-perpetuating board, a common method of nonprofit governance.”

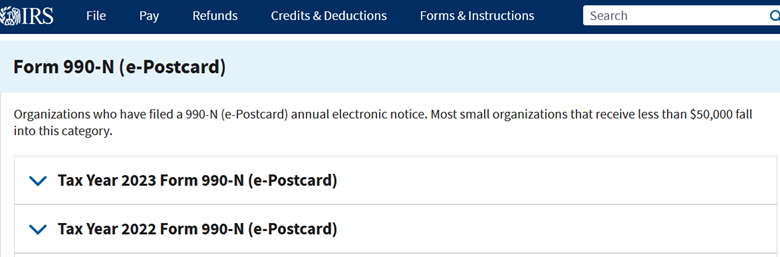

Best governance practices decry self-perpetuating boards of directors that are comprised of non-independent members. Self-perpetuating boards made up of mostly family members is a practice called nepotism and it facilitates self-dealing, especially in churches and church affiliated organizations since they are not required to file any public financial information.

Moreover, self-perpetuating boards are historically not common among churches, and even less among Baptist Churches. However, it’s a much more recent trend—especially among independent large churches where pastors seek to exercise control with little or no accountability.

David Morrill of the independent religion news website Protestia wrote “Warlords of the Ghetto…” and he zeroed in on this same subject of church governance last week:

“In its biblical and historic form, plural eldership exists within a framework of meaningful congregational authority. Elders lead; congregations retain the power of recognition, correction, and removal. As has been noted many times recently, elder plurality was never intended to create self-generating spiritual authorities insulated from the people they serve. But when elder rule is severed from real congregational oversight, it becomes something else entirely.” (our emphasis)

More challenges in Brewer’s brief to the court

His brief states, “the Court should first resolve issues of jurisdiction, standing, and church autonomy before addressing the substantive legal matters raised by this motion.” It’s our understanding that the defendant has already asked and received a change of venue during the early months of the lawsuit from the Texas district court to the Texas business court.

With respect to church autonomy, JCC has indicated that the lawsuit is not about theology, but rather is about legal, ethical, and financial accountability, as stated previously; i.e. purely a business matter.

Brewer’s brief says JCC’s lawsuit “grossly overreads the import of the 1928 Articles and 1978 Amendments as they pertain to church members’ voting privileges”.

Trinity Foundation reviewed the original articles from 1928 and the amendments, and they read as follows: “This corporation shall have 6 trustees, who may be either elected annually or in classes with terms of office not exceeding 3 years as this corporation may from time to time deem desirable.” The 1978 amendments read, “Pursuant to the provisions of article 2.20 of the Texas nonprofit corporation act, the church trustees have been expressly powered by second Baptist Church to act as its officers.” (January 19, 1978).

Brewer argues that this terminology is insufficient, that it’s dated, and that it expired long ago. However, he does not say exactly when it expired.

The 2005 amended bylaws clearly define the membership of the church, as congregants who have expressed a desire to join the church by four different means common to other Baptist churches and clearly gives them the right to vote at church business meetings, “Every member of the church is entitled to vote at all church business conferences, provided the member is present.”

Brewer’s brief alleges that JCC’s lack of additional citations other than Texas Business Code 22 is insufficient.

He’s partly correct in that there are not many precedents available to cite. The case is unusual because in Trinity Foundation’s decades of experience, church takeovers are generally not contested. It’s a costly proposition to file a church takeover case in civil court. In these situations, members generally grieve their lost church family and friends, as well as their spiritual and monetary contributions—and then they move on.

The church world in America needs more case law precedent as church takeovers are becoming more common.

Brewer emphasizes that the church gave sufficient notice, though that has been challenged by the JCC members. His brief ignores the claims that congregants were led to believe that the meeting was called to protect the church from a “woke” agenda and that meeting participants were not given copies of the bylaws to review in advance of the meeting or during the meeting.

Brewer’s brief states, “In other words, the over 300 members present at the May 31, 2023 meeting expressly gave up the right to vote on church business by 315-2 majority.” In fact, they could not have expressly given up the right to vote because they were not told that these bylaws eliminated the right to vote.

How do you expressly give up a right when you are not told or given a copy of the document you are asked to vote on and you are voting based on a presentation which did not include this important fact?! Informed consent is critical when voting on matters important to congregations.

Trinity Foundation will be watching this case closely.