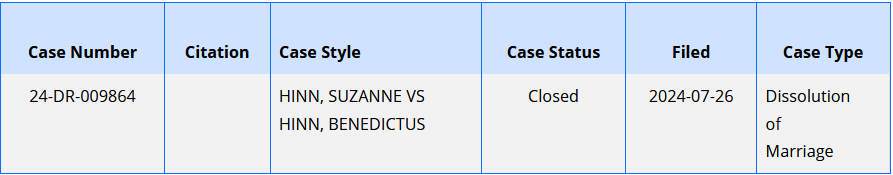

(Screenshot: Kevin Adell being interviewed following Novi city council approval to build the Adell Center.)

The federal government’s civil case, filed in April 2023, to seize the $4 million Bloomfield Hills, Michigan, home of The Word Network President Kevin Adell has been postponed for 90 days due to the federal government shutdown. Adell is accused of owing almost $18 million in estate and gift taxes after his father Franklin Adell died in 2006.

Franklin Adell founded The Word Network which was later marketed as “the largest African-American religious network in the world.” However, due to recent programming changes, most of the preachers on The Word Network are now caucasian.

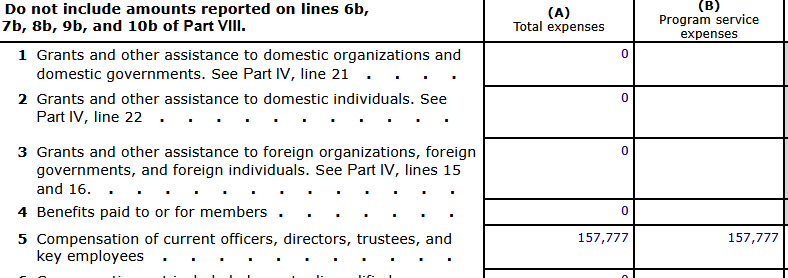

In 2015, the IRS revoked the tax-exemption of The Word Network’s previous parent World Religious Relief which Adell replaced with a new non-profit organization Church of the Word.

Adell also owns 170 acres of real estate in Metamora, Michigan, worth more than $2.6 million, according to real estate website Zillow. Adell’s Naples, Florida, beach house is currently for sale with a list price of $8.9 million (down from $10 million), featuring a large boat dock located near the Naples Yacht Club.

(Photo: Satellite view of Naples Yacht Club and nearby homes.)

Adell’s mountain home in Sundance, Utah, home of the Sundance Film Festival, is worth over $6 million, according to Redfin and Zillow real estate websites.

Adell’s wealth also financed a large car collection. In 2019, Hagerty reported that Adell’s “fleet of 100 or so automobiles” features newer hypercars and automobiles from old TV shows such as the Batmobile from the 1960s TV series and one of the General Lee cars from “The Dukes of Hazzard.”

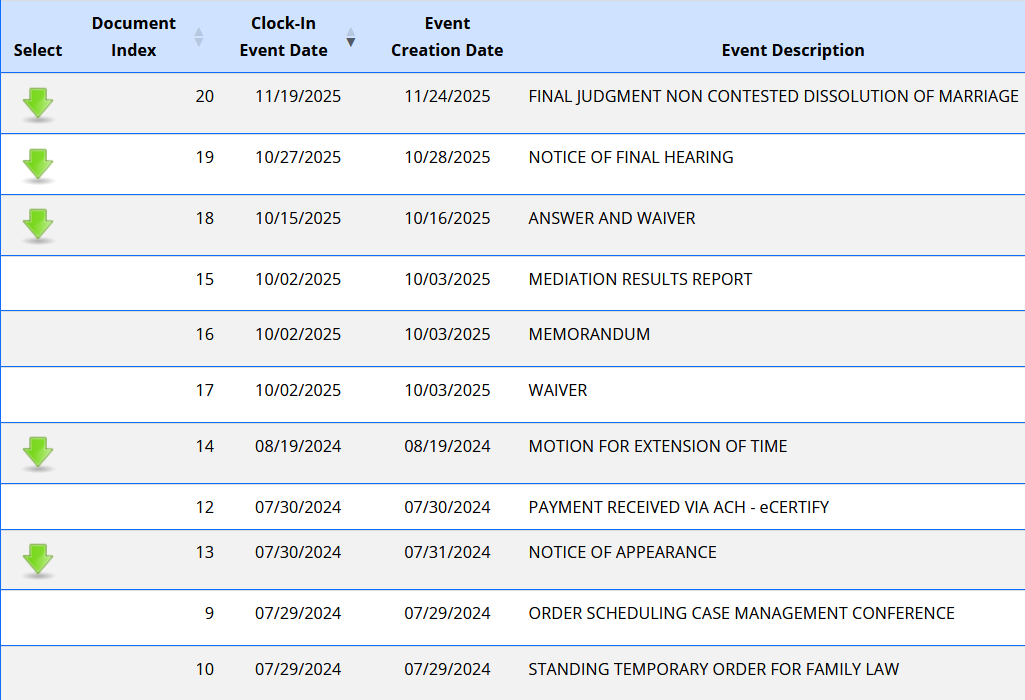

Recent Court Filings

The Motion to Stay and the Joint Motion to Extend Trial and Related Deadlines were filed in the United States District Court for the Eastern District of Michigan Southern Division.

The failure by Congress to pass an appropriations bill to fund government operations resulted in the government shutdown, as explained in the Motion to Stay:

“At the end of the day on September 30, 2025, the appropriations act that had been funding the Department of Justice expired and those appropriations to the Department lapsed. The same is true for the majority of other Executive agencies, including the federal Plaintiff. The Department does not know when such funding will be restored by Congress.

“Absent an appropriation, Department of Justice attorneys and employees of the federal Plaintiff are prohibited from working, even on a voluntary basis, except in very limited circumstances, including “emergencies involving the safety of human life or the protection of property.”

The Joint Motion to Extend Trial and Related Deadlines has postponed Adell’s trial until “July 13, 2026, or later.”

Other church and ministry court cases might be postponed by the federal government shutdown, if it persists. We will continue monitoring the federal courts and will post updates as new motions are filed.

(Photo: Suzanne and Benny Hinn saying their wedding vows for a second time in 2013.)

(Photo: Suzanne and Benny Hinn saying their wedding vows for a second time in 2013.)