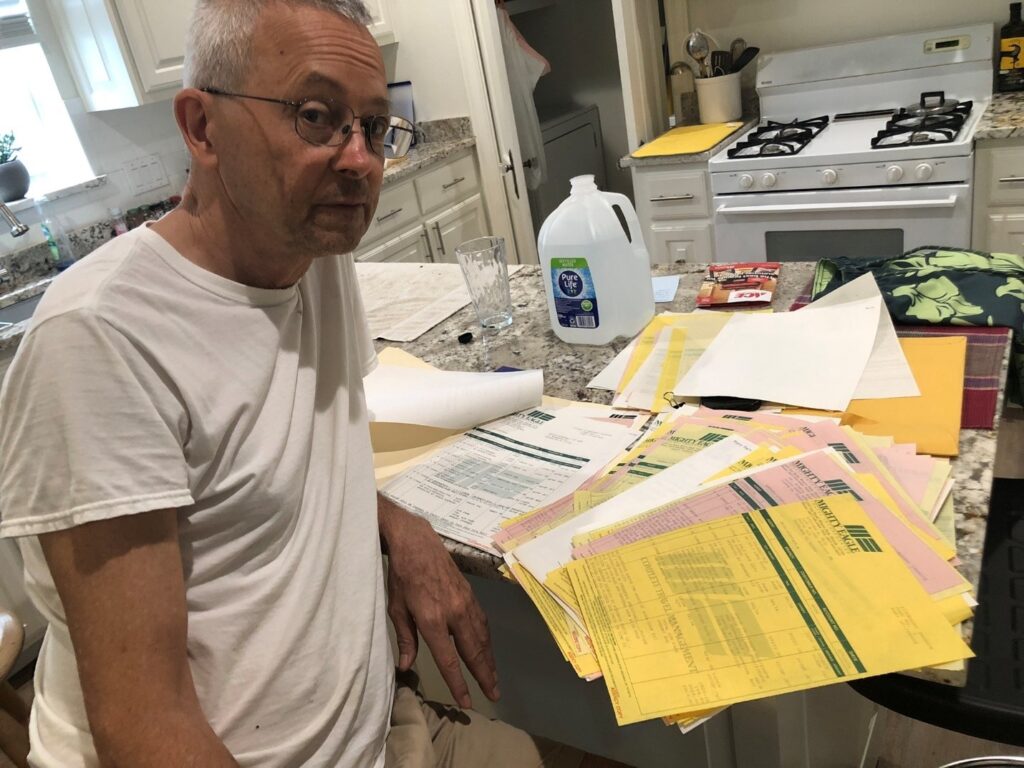

(Trinity Foundation President Pete Evans reviewing documents obtained from dumpster diving in 1996.)

Inspired by the FBI’s Vault, a collection of more than 6,000 government documents, Trinity Foundation has created the File Vault, a document library, to expose the techniques that televangelists use to defraud their donors, to avoid financial transparency, and to avoid legal accountability.

We want donors to see with their own eyes how the scams work by publishing documents of historical importance. In 1987, televangelist Oral Roberts claimed that God commanded him to raise $8 million or God would take his life. Before making the announcement on television, Roberts sent a fundraising solicitation letter to his large mailing list.

Mailing lists are one of the biggest fundraising tools of religious broadcasters. Five of Oral Roberts’ 1987 fundraising letters are published in the File Vault including the letter in which Roberts announced the $8 million threat from God, and the countdowns to his death IF sufficient funds weren’t raised.

Another goal of the File Vault is to provide easy access to government reports and court filings.

Following the Jim Bakker scandal, a congressional hearing was held in which Congressmen and religious leaders discussed how to reduce financial abuses by religious organizations. Trinity Foundation’s late president Ole Anthony provided testimony to the hearing. The IRS responded to calls for increased enforcement by auditing a significant number of ministry non-profits involved in religious broadcasting.

Because of the 1974 Privacy Act, the IRS was prohibited from revealing the names of organizations being audited or investigated but did provide status reports to Congress revealing how many ministries were being audited. Three IRS audit updates from the early 1990s are included in the File Vault.

Following 9/11, Senator Chuck Grassley began investigating American charities that abused their tax-exempt status by committing restricted donation fraud and other crimes. Grassley solicited investigative reports from Trinity Foundation in 2006 and 2007. In 2007, at Grassley’s request, and using reports from Trinity Foundation, the Senate Finance Committee launched an inquiry into six TV ministries that avoided disclosing financial information to the public by not filing Form 990s.

In 2011, two Senate Finance Committee staffers compiled a memo identifying loopholes being exploited by religious organizations.

The Senate Finance Committee report is recommended reading for anyone concerned about financial reform for churches and ministries.

Governing documents of religious non-profits are also shared in our File Vault. While articles of incorporations are frequently easy to obtain by Secretary of State websites, church bylaws are often secret.

By litigation and other means, Trinity Foundation has obtained bylaws for the churches of Kenneth Copeland and Paula White. These bylaws eliminate accountability for leadership. Paula White has veto power over her church board.

Before the widespread use of paper shredders, Trinity Foundation conducted dumpster diving at churches, law offices and related companies to obtain evidence of crimes. In 1996, during the daytime, Trinity Foundation investigator Pete Evans worked undercover at Benny Hinn Ministries but at night went through the trash of Mighty Eagle Travel, a travel agency operated by Hinn’s brother Christopher Hinn.

Evans, who became president of Trinity Foundation in 2021 following the death of founder Ole Anthony, documented the expensive flights and hotel room reservations of Benny Hinn and found aliases the televangelist used when traveling.

In February 2005, a shredded list of executive salaries was obtained from Benny Hinn Ministries and taped back together, revealing Hinn’s church salary to be $1,325,000, his wife Suzanne’s salary of $165,000, his then young daughter’s salary at $65,000, and young son-in-law’s salary at $90,000.

Additionally, a company Hinn’s lawyer created that same year to give an impression of “arms-length” transactions called Clarion Call Marketing was slated to pay Hinn an additional $30,000 monthly ($360,000 yearly).

The tax code classifies salaries of over $1 million for non-profit administrators as excessive compensation and provides tax penalties for these salaries, but a loophole in the law prohibits the tax penalties being applied to clergy.

Compensation information for the Hinn family and employees as of 2005 are featured in File Vault.

We will continue to add to this “Vault” as time allows. Next week, we will add televangelist Ed Young’s governing documents and Second Baptist Church Houston’s documents to our file vault.