Most Christians don’t give it much thought and trust their leaders. We tend to look to a pastor, priest, or whomever is in charge as the expert(s). But members and donors have a responsibility to make sure their tithes and gifts are doing more than simply enriching the person or persons at the top.

Givers should, at a bare minimum, seek answers to: 1) Who governs the organization or church—a single individual with little or no accountability or an independent group of individuals such as a board of directors? 2) Where does the money go? Do they file a public form 990 or publish an audited financial statement?

Trinity Foundation has encountered all types of organizational and church governance (read our Governance Project) and while there is probably no “best” form, there are certain things members should look for and others to be wary of. We’ve seen terrible examples over and over and can best describe the better leadership forms by what they are not.

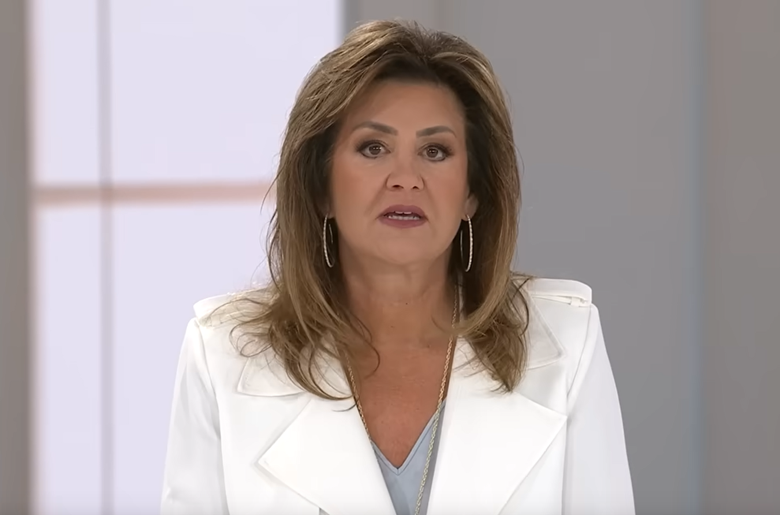

Decades ago, we discovered televangelists and pastors had begun eliminating church member oversight and personal accountability. We found that all decision-making power in a board of directors often consists of hand-picked family, friends, or employees. We discovered that more and more pastors are consolidating power in their organizations and eliminating church member oversight.

The “smell factor”

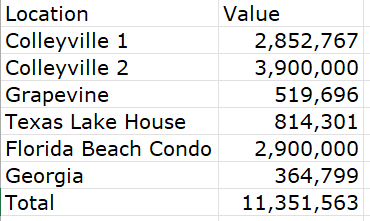

If a certain pastor or ministry leader is living lavishly (any one of the following—a corporate jet, a mansion, multiple houses, a luxury car, etc.) this lifestyle begs the question—is this person more concerned about themselves or the gospel of Christ and others? Are they a lover of money? When the smell is “off”, so to speak, donors need to start asking questions.

The pattern set forth in the gospels is one of servanthood and humility, not of “lording it over” congregations or members. If it begins to smell foul, both the person and the organization deserve a closer look and some good-old-fashioned research.

Questions Donors Should Ask:

Does the leader regularly preach, teach, or advocate the life and teachings of Christ, including the cross? The Apostle Paul said, “For I determined not to know anything among you, save Jesus Christ, and him crucified.”

Does the pastor or leader constantly refer to themselves, other than confession?

Is the church or ministry transparent?

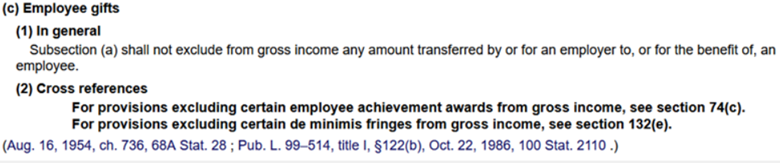

How are your donations being used? We can’t emphasize enough that churches and organizations should publish or make available financial documents illustrating how donor money is spent. They should file the IRS form 990 or publish an audited financial statement on their website.

Do excess church funds simply accumulate to make the church wealthier, or do they help the poor, needy, distressed, and disadvantaged in the community?

Does the pastor or ministry leader’s family control how and where the money is spent?

Is there a group of people that hold the leader responsible, such as an independent board of elders, deacons, or board members?

Leadership Standards

Does the leader have integrity as defined by the Apostle Paul? (1st Timothy, chapter 2) A bishop then must be blameless, the husband of one wife, vigilant, sober, of good behavior, given to hospitality, apt at teaching; not given to wine, not violent, not greedy for filthy lucre, but patient, not a brawler, not covetous; one who rules well his own house, having his children in subjection with all dignity.