Researchers at the Center for the Study of Global Christianity, writing for the International Bulletin of Mission Research, estimate that $55 billion will be spent on foreign missions in 2023. That may seem like a lot, but the same researchers also estimate that Christian religious leaders will embezzle $62 billion in 2023.

Foreign mission organizations are notorious for their lack of transparency. Gospel for Asia, which raises millions of dollars to support missionaries, doesn’t disclose to donors important financial information such as total annual revenue, total annual expenses or compensation for highly paid executives.

Compounding the problem, American tax laws are poorly understood and poorly enforced, often resulting in noncompliance. If a church operates a mission project in a foreign nation with a foreign bank account and the foreign account exceeds $10,000, the church is required by the Bank Secrecy Act to file a Report of Foreign Bank and Financial Accounts (FBAR).

To make matters worse, if a church or ministry reports a foreign bank account, the report is confidential and cannot be revealed to church or ministry donors. Corrupt religious leaders can engage in international money laundering and the existence of their foreign bank accounts are shielded by privacy laws.

Australian Charity Rules

Some countries such as Australia have stricter laws regarding foreign reporting and foreign expenditures for churches.

In 2022, Hillsong Church employee Natalie Moses turned whistleblower. Moses served as Fundraising & Governance Coordinator for Hillsong Global Corporate Group.

According to Moses’ statement of claim, Brian Houston, the founder and former senior pastor of Hillsong “announced that $10,000 would be given to persons who were his former interns and who had sought to start a ‘Hillsong’ Church in Bucharest, Romania.”

Moses responded by informing a supervisor the direct cash payments to individuals in Romania by Australian non-profit organizations was prohibited.

To avoid violating Australian law, Hillsong Global LLC (an American non-profit limited liability company) transferred the funds. Meanwhile, Hillsong Global does not file a Form 990 disclosing its foreign spending because American churches and church integrated auxiliaries are exempted from filing the non-profit information return.

Moses raised additional concerns that Hillsong was failing to comply with Australian laws.

Australia has adopted Four External Standards which regulate foreign non-profit spending and reporting. Australian churches are not exempt from these standards.

The Australian Charities and Not-for-Profits Commission requires foreign financial records to be “complete, accurate and legible.” Australian churches and ministries should compile a list of all foreign third-party organizations they collaborate with. Non-profit organizations are expected to document criminal and illegal activities committed by employees after misconduct is discovered.

Unfortunately for Australian Christians, these complete records are not available for church donors. Instead, they must be made available to government officials that request them.

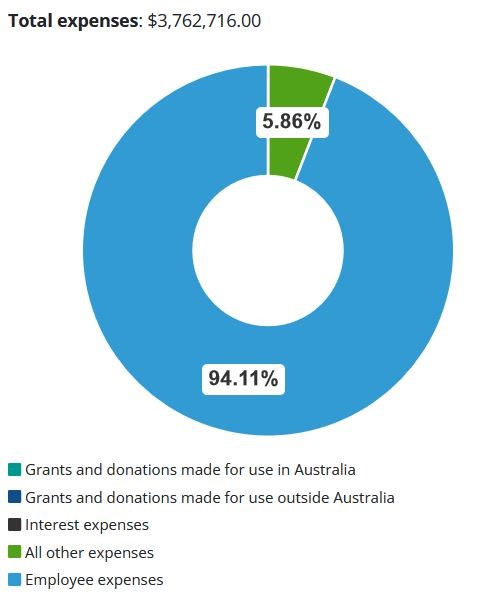

The Australian Charities and Not-for-Profits Commission provides basic financial information for Australian churches and ministries, but good luck finding Hillsong Church’s foreign missions expenditures.

(Photo: Hillsong Church Ltd. reporting no foreign expenditures for 2021.)