Thursday, September 19th is North Texas Giving Day. Fundraising is one of our least favorite activities, but it is necessary to fund our investigations of religious financial fraud. Before asking for any donations, we would like to provide a couple of updates on our investigations.

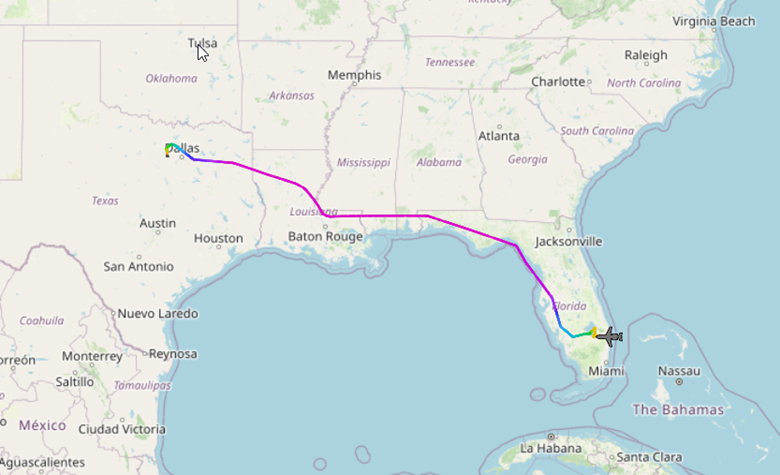

September 16th Was Super Busy Day for Ministry Aircraft

Our Pastor Planes Project monitors 66 aircraft, mostly jets, to document and bring transparency to religious non-profit organizations’ travel costs, many of which do not disclose travel expenses to their donors on a Form 990.

September 16th was one of the busiest days for religious non-profit aircraft. We tracked 17 aircraft in the air. Twenty-five percent of the aircraft we monitor were in use in one day! Many of these religious non-profits could save a large amount of donor money by using commercial aircraft.

(Photo: Sixteen aircraft flying over North America. Another ministry jet flew from Brazil to South Africa.)

We post daily aircraft tracking maps to Instagram and X (formerly Twitter).

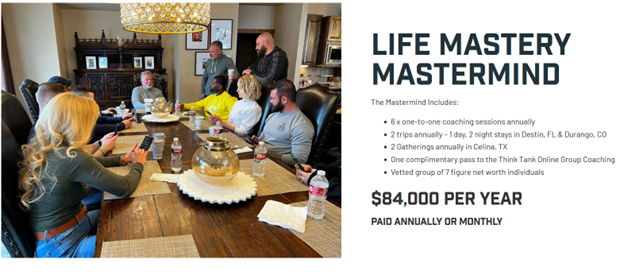

Extravagant Lifestyles

Journalists have barely scratched the surface when it comes to reporting on the accumulation of wealth by religious leaders.

In recent weeks Trinity Foundation has identified several multi-million-dollar houses belonging to daughters of televangelists. We have also discovered African preachers with vacation homes in the United States. Future articles will explore these topics.

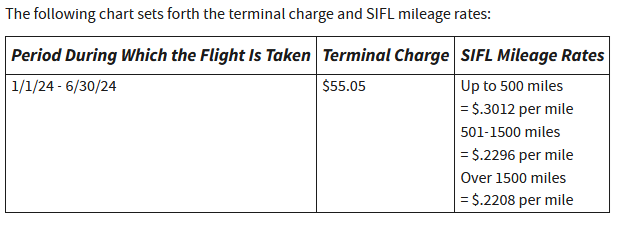

Excess Benefit Transactions

The United States tax code currently prohibits excess benefit transactions for officers of non-profit organizations. When a pastor receives an excess benefit through the personal use of church assets, the pastor is required to pay an excise tax to remedy the problem.

While there are loopholes in the law acting as a deterrent to government oversight, Trinity Foundation is researching methods for increasing IRS enforcement to stop these financial abuses.

North Texas Giving Day

To all our donors and everyone reading our newsletters and website: Thank you for your support and encouragement.

We disclose our total revenue and expenses to the IRS on a Form 990EZ and republish this document on our website so that donors have adequate financial information to evaluate our work.

Trinity Foundation currently employs only two investigators. To increase our effectiveness in combatting religious fraud, we would like to raise funding to hire new personnel.

Another investigator could help us research international money laundering. A social media manager could post regular updates to Facebook, Instagram and Twitter while answering questions from the public. A video editor could assist us in making YouTube and TikTok videos about religious abuses.

If you would like to donate or become a member of Trinity Foundation, please visit this link.