(Screenshot: Benny Hinn appearing in a Trinity Broadcasting Network telethon.)

It rarely gets media attention, but for decades so-called prophets have targeted wealthy individuals with personalized prophecies for the purpose of obtaining lucrative donations.

We’ve collected several examples below.

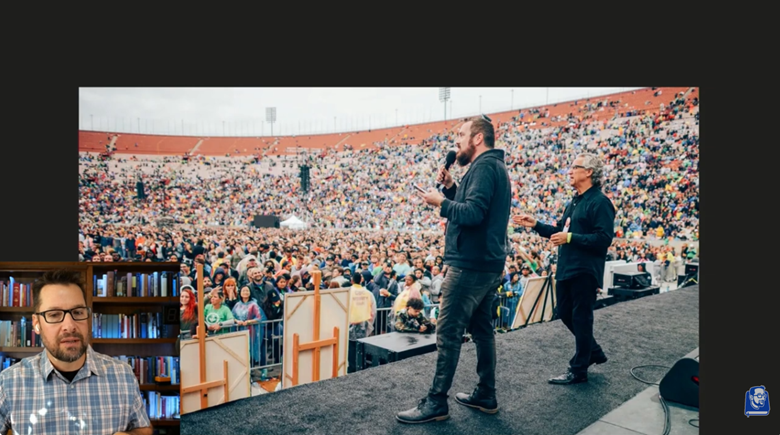

This corrupt practice was discussed in Bible teacher Mike Winger’s recent exposé of Shawn Bolz.

Mike Winger: “I’m going to call them Bob and Sally…Bob and Sally were a couple that was very well off, and they had the beginnings of this business that was skyrocketing, like you know, crazy, crazy money. That was the direction that it was heading. That is very attractive to the prophet crowd… those guys that they love, the rich big money bags guys that they can prophesy to, sincere Christians who love Jesus and just happen to have a load of cash. All of a sudden, you get special words of knowledge for those people.”

Winger reports that Mike Bickle, Shawn Bolz and Stacy Campbell, all leaders in America’s prophetic movement, attempted to recruit Bob and Sally.

You can view the exposé here.

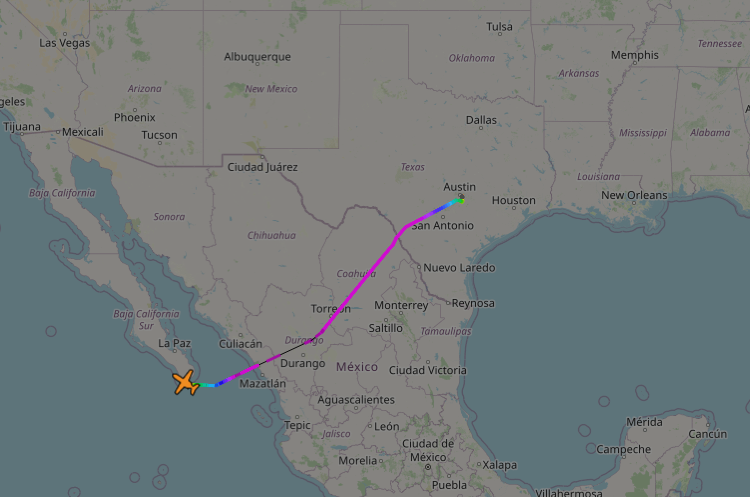

False Prophet William Branham’s Wealth and Jet

When evangelist William Branham died in 1965, he left behind properties, stock and a large amount of cash.

In 1989, Branham’s daughter Sarah Branham De Corado revealed in a letter, “Just recently a noted lawyer in New York looked into the matter and showed me different bank statements which are still in my possession. One shows the amount in cash of 3,113,676 plus stocks 130,645 plus other things. This money was left untouched since the departure of my father. According to the notary document it is fixed for 25 years. I am asking myself what will be done with the large sum of money accumulated by now after the 26th of October, 1990.”

Continue reading “False Prophecy as a Path to Riches, Part 2: Targeting Wealthy Donors”